Let’s use spread trade(High-Low/Turbo) in High-Low Australia

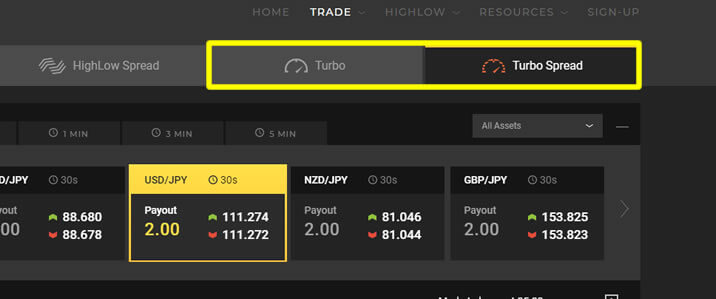

The name changes from on-demands to turbo!

High-Low Australia changes to platform 2.0 in Oct 2016. The name also changed from “on-demand” to “turbo.”

Apart from the name “Turbo,” The contents do not change so much. However, the 30 seconds trade is added in this short period trade.

I can say that High-Low Australia is a trend now because of this changes.

If you already know spread well, let’s quickly look at it.

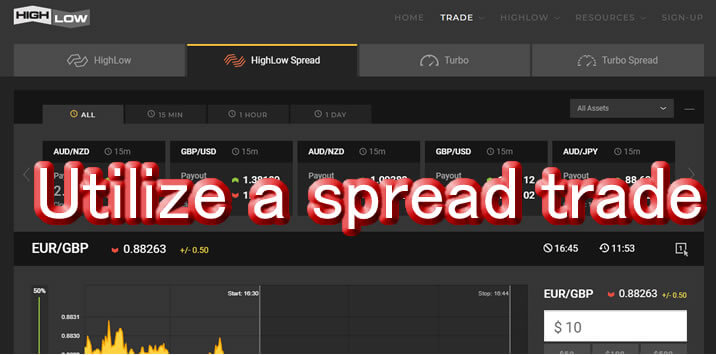

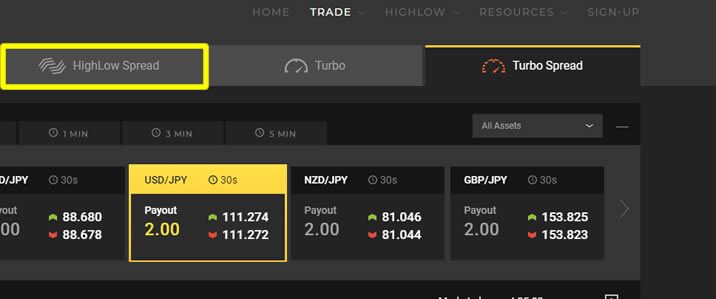

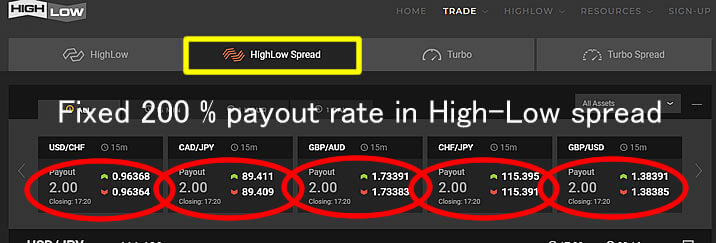

The name changes from spread High-Low to High-Low Spread

In High-Low Australia 2.0, The name of “Spread High-Low” also slightly changes to “High-Low spread” as you can see in the picture above.

There are not so many significant changes in trading. If you are a loyal user, it is easy. There are also 15minuts and 1-hour trade for mid-long term trader.

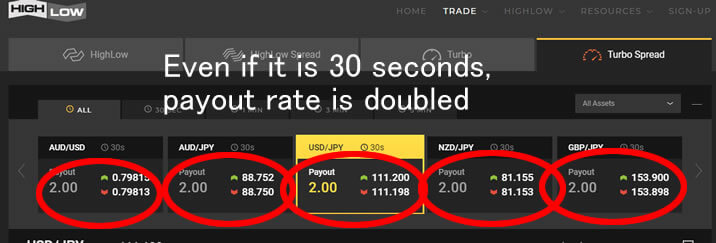

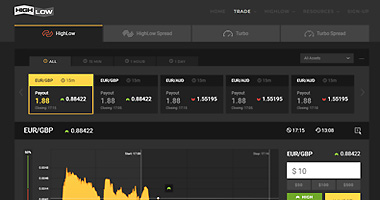

The famous 200% payout rate in short-term trade

As I said above, High-Low Australia 2.0 adds 30 minutes trade in the turbo. Even it is so; it still has fixed doubled payout rate, which makes us happy.

You also choose 1, 3, and 5-minute trade.

Of course, you can trade with 200% payout rate in mid-long term High-Low spread. It is suitable for a trader who wants to deal more than 15 minutes.

High-Low spread has lots of currency pairs than turbo spread so that you can trade with various pairs.

You can get high returns in the time when you want to trade. No matter what type of trade you are, from short term to long term, I recommend this broker.

The difference between spread trade and others

The advantage of spread trade should be the high payout rate.

You can get a high return; If you invest 10USD, you can get the 10USD return as well.

However, if you just focus on the advantage, you may fall. You also need to check the disadvantage.

Even if I said like that, the only disadvantage I could find was that there were “Spread” in turbo spread and High-Low spread.

You know the outline of trader if you have already experienced High-Low spread and turbo spread. It is easier to understand when you think the spread is the same as out of range.

In High-Low and turbo, you win if the rate is higher or lower than the set value. If the price is inside the spread, you lose regardless of your expectation.

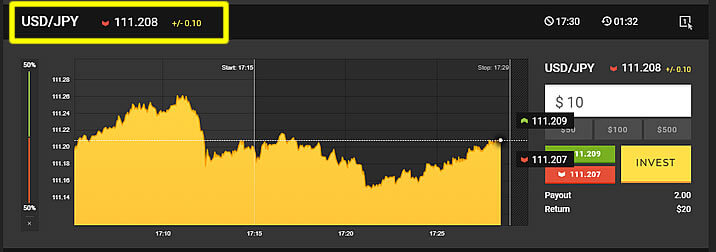

Look at the picture above. The light blue line is the realm of spread. You have to guess whether it goes higher than that range of lower.

In High-Low Australia, if you get a draw or the rate is inside the light blue line with High-Low and turbo, you lose the bet because it is judged as out.

The shorter trading time you have, the narrower spread width you see in High-Low Australia.

For example, the picture above are the screen in 30 minutes; you can see that it is ±0.10.

0.10 in High-Low Australia means 0.1 pips. If you have USD/JPY pair and it moves more than 0.001yen, you win. If you have EUR/USD pair and it runs more than 0.00001USD, you win. As you can see, you can earn a little price with a bit of movement.

Depended on the time and pair, High-Low Australia has around 0.1pips – 6.1pips spread width. If you want to trade in the short term, it is about 0.1pips – 6.1pips.

If you find the key to the trade, you make a benefit with MT4 in turbo and High-Low spread.

How do you use 200% in short-term trade

Let’s think the tactics in turbo spread and High-Low spread. Predominantly, you cannot do this in a trending market.

There is no draw here. In that case, if you trade in a range market which fluctuates around the similar price, the rate can be in the spread easily.

You cannot trade with many currency pairs so that you have to learn the feature of each pair. It is also good to choose EUR and GBP which shows very fluctuating movement.

It is also better to know the timing when price moves and you can choose whether turbo and High-Low or spread depended on the situation.

Category:High Low Australia

New Comment